For Investors

How we support investors

We have experience of working alongside the investment community, including angel groups, government sponsored bank lending, venture capital and private equity and have worked with early stage founders as well as Series C+ GTM teams.

We understand that sometimes your investees need support with defining and executing their GTM strategy. We also understand that complex relationships exist between investor and investee teams and the benefits that a third party team can bring to the mix. We’re happy to help with pre-investment due diligence by providing an independent view of an investee’s GTM opportunity and the their current ability to execute it.

We can also help when an existing portfolio company is missing revenue targets or no longer appears to be aligned with the agreed pre-investment GTM strategy. We do this by re-assessing their approach and providing a detailed report on the factors limiting performance and our recommendations for adjusting and re-aligning the GTM strategy and its execution.

If you are an investor and would like GTM support for an investee company, please contact us to find out more.

We offer the following services to investors:

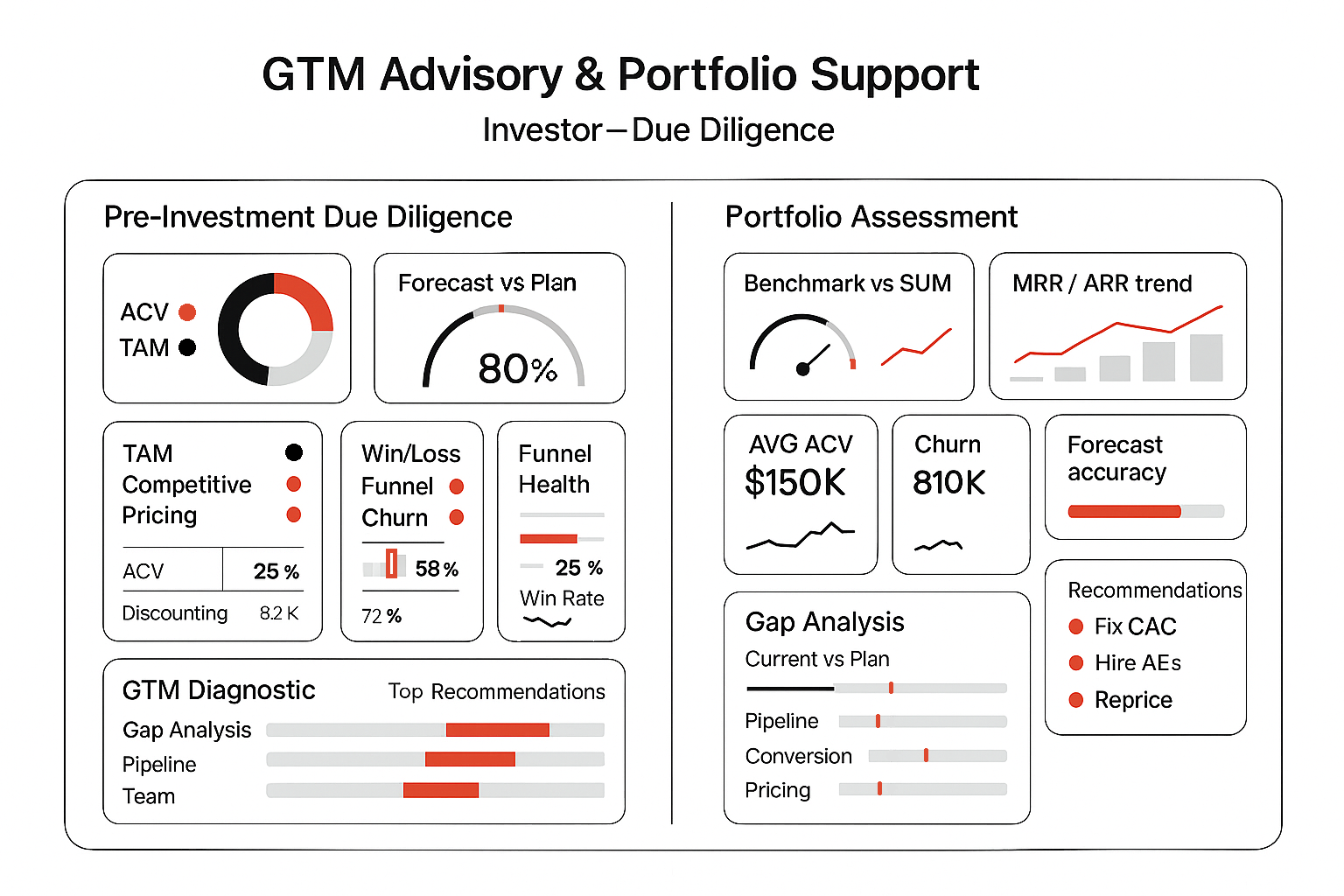

GTM advisory and portfolio support

- Pre-investment GTM due diligence

- Investigation and report into the GTM set up of prospective investee companies to facilitate modelling of future revenue performance and related data to support investment decisions.

- For investors in early stage companies (pre-seed and seed) we offer a fixed price report.

- GTM assessment and benchmarking for investee companies

- Review and recommendations of the GTM in your investee companies and benchmarking against key performance indicators from the SUM Framework.

- Areas that we assess include product market fit and product roadmap, messaging, TAM and ICP, competitive analysis, product pricing, value based selling, building pipeline, GTM team structures and compensation, GTM systems and processes, GTM motions, alliances, qualification, forecasting, deal structures, and customer success.

- Data and metrics that we capture include opportunity tracking and pipeline forecast by stage, MRR, ARR, ACV and CAC.

- GTM diagnostic

- Identify problem areas in investee companies that are struggling with GTM or missing revenue targets. The report includes a detailed gap analysis of current GTM vs. planned GTM as per the company’s business and revenue plans and suggested focus areas for improving performance.

Support for investee companies

We offer the following support to investee companies:

- GTM Solutions or GTMaaS

- Our full solution offering to build a revenue engine within an investee company that can deliver against planned revenue targets.

- Targeted GTM support for investee companies

- Support with a specific GTM area or initiative.

- Investee report and follow up post assessment/diagnostic

- Following an assessment or diagnostic, we can provide the investee company with a summary of our findings and work alongside you and the investee company to implement any GTM transformations.

- Fractional GTM support

- One of our team working within an investee team.

- Founder support/mentorship

- Post acquisition GTM integration support

- GTM training for investee cohorts

- GTM strategy and tactical training sessions for founders and senior GTM leaders in investee companies.

- Training is based on the SUM Framework and covers all core modules.

- Training delivered in groups by GTM maturity. Training can be delivered for single investee companies or for groups of related companies, if appropriate.

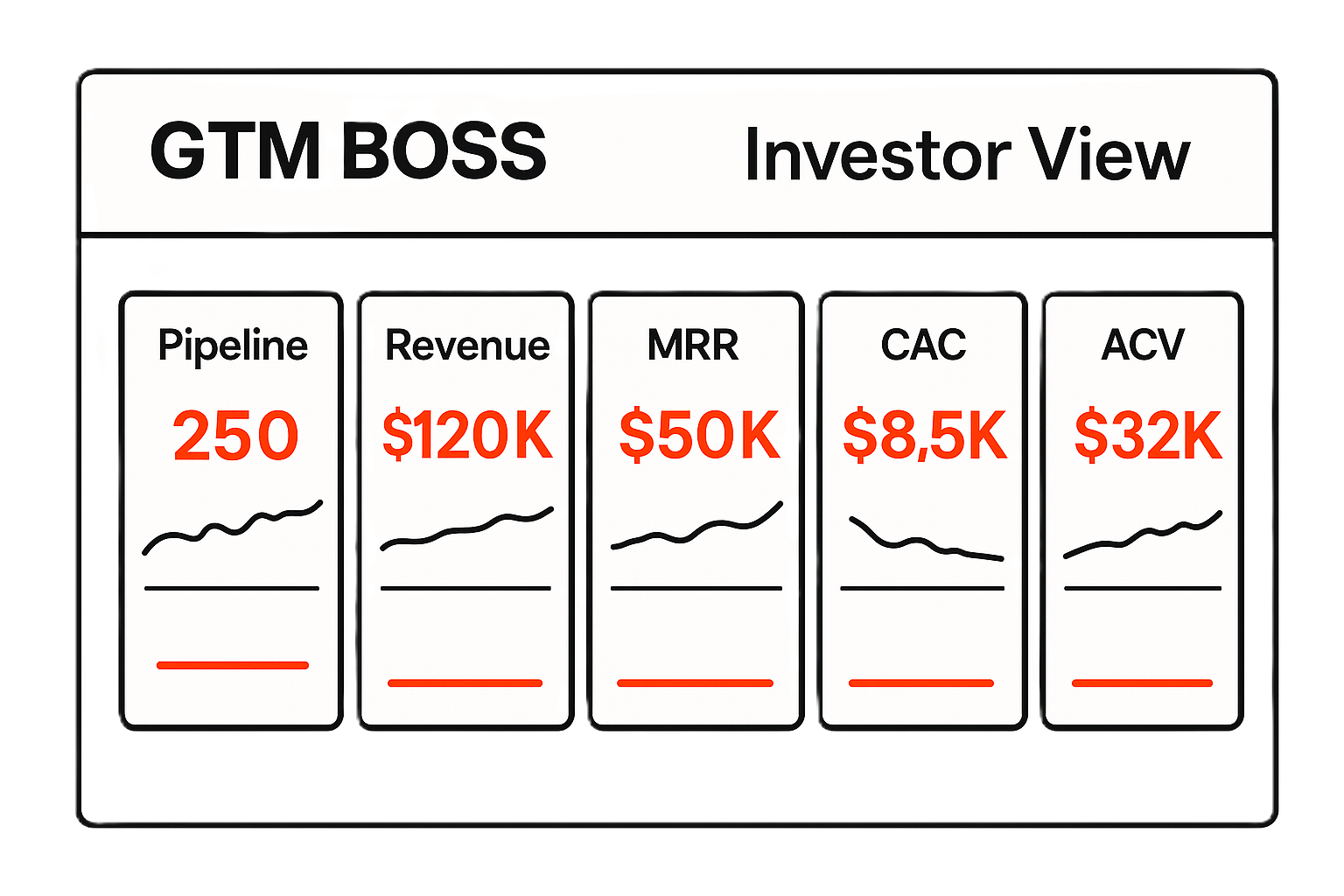

GTM BOSS Investor View

Track key sales and revenue metrics within investee companies using our customisable GTM BOSS Investor View, and track metrics and progress against the plan in real-time; for example:

- Pipeline

- Revenue

- MRR

- CAC

- ACV

Track key sales and revenue metrics within investee companies using our customisable GTM BOSS Investor View, and track metrics and progress against the plan in real-time.